UK Chancellor Rachel Reeves delivered the Autumn Budget on Wednesday, October 30, with a clear focus: restoring stability and driving growth. The Labour government’s first Budget outlines important measures affecting individuals and businesses alike, with notable changes in personal taxation, cost-of-living relief, and business contributions. Here’s a summary of the key points.

Economic Growth and Projections

The government aims to bolster the UK economy, with growth forecasts from the Office for Budget Responsibility (OBR) predicting modest increases. The economy is projected to grow by 1.1% in 2024 and 2.0% in 2025. While this Budget offers a short-term economic boost, the OBR expects long-term output to remain stable, averaging a 1.6% growth over five years. Inflation is forecasted at 2.5% for 2024, with a slight rise to 2.6% in 2025.

The Budget revolves around seven strategic growth areas, including regional investment, workforce skill improvement, and a commitment to Net Zero—signifying the government’s priorities in sustainability and resilience.

Cost-of-Living Measures

To address the ongoing cost-of-living crisis, Chancellor Reeves announced several measures to support individuals:

- National Living Wage: From April 2025, it will rise from £11.44 to £12.21 per hour, providing a 6.7% boost to help offset inflationary pressures.

- Fuel Duty: The 5p fuel duty cut is extended through March 2026, accompanied by a freeze on any further increases.

- Carer’s Allowance: Carers can now earn up to 16 hours’ worth of wages at the National Living Wage rate without impacting their allowance.

- Local Authority Support: An additional £1bn has been allocated to assist those facing immediate financial hardship, supporting vulnerable households.

These measures aim to reduce financial strain on households, though rising costs remain a concern for many households.

Personal Taxation, Savings, and Pensions

The Chancellor preserved the current structure for income tax, National Insurance, and VAT, while introducing some significant changes in inheritance and savings:

- Inheritance Tax (IHT): Nil-rate bands remain frozen until 2030. From April 2026, Agricultural and Business Property Relief will shift to a tiered approach, with a 100% relief on the first £1m, dropping to 50% for amounts above that.

- New Residence-Based Tax Regime: Non-domiciled status will be replaced with a residence-based system from 2025, ending tax relief for offshore trusts. This change aims to increase contributions from foreign nationals who previously benefited from tax exemptions.

- State Pension: The Triple Lock remains intact, resulting in a 4.1% increase in the basic and new State Pension in 2025-26.This results in a weekly payment of £230.30 for the full, new flat-rate State Pension for individuals who reached State Pension age after April 2016, and £176.45 per week for the full, old basic State Pension for those who reached State Pension age before April 2016.

Furthermore, ISA limits are retained until 2030, allowing individuals to continue maximising tax-free savings.

Business Contributions Increased

Businesses will see increased responsibilities as part of the government’s strategy to fund public services:

- Employers’ National Insurance Contributions (NICs): NICs will increase by 1.2 percentage points to 15% from April 2025. The secondary NIC threshold will be reduced to £5,000 annually, with the Employment Allowance rising to £10,500.

- Corporation Tax Cap: The corporation tax rate remains capped at 25%, promoting stability for companies.

- Support for High Streets: Retail, hospitality, and leisure businesses will benefit from reduced rates and relief capped at £110,000 per property from 2026-27. Additionally, £1.9bn has been allocated to help rejuvenate high streets.

These measures signal a strong push from the government for larger corporations to contribute more to public funds.

Health and Education: Building for the Future

Investments in health and education form a substantial part of the Budget, with the Labour Government prioritising quality improvements and access:

- State Schools: An additional £11.2bn is allocated for education, with £1bn for SEND provisions, expansion of breakfast clubs, and enhanced childcare support.

- Private Schools: Starting January 2025, VAT will apply to private school fees, with business rates relief ending in April 2025.

- NHS Budget: The NHS will receive an additional £22.6bn, with a 10-year plan set to tackle waiting times and improve access to healthcare services. A £3.1bn boost for capital funding will aim to support essential infrastructure projects.

This investment is designed to strengthen essential services, meeting the needs of communities across the UK.

Other Notable Announcements

Several targeted measures were introduced, impacting a range of sectors:

- Stamp Duty Land Tax: Rates on second homes and buy-to-let properties rise from 3% to 5%, effective from October 31, 2024.

- Help to Save Scheme: Extended until April 2027 to help low-income savers.

- Clean Energy Investment: The Budget allocates £3.9bn for clean energy projects, supporting the government’s Net Zero ambitions.

- Air Passenger Duty: Rates on domestic and international flights will increase from 2026, with a 50% rise on private jet fares.

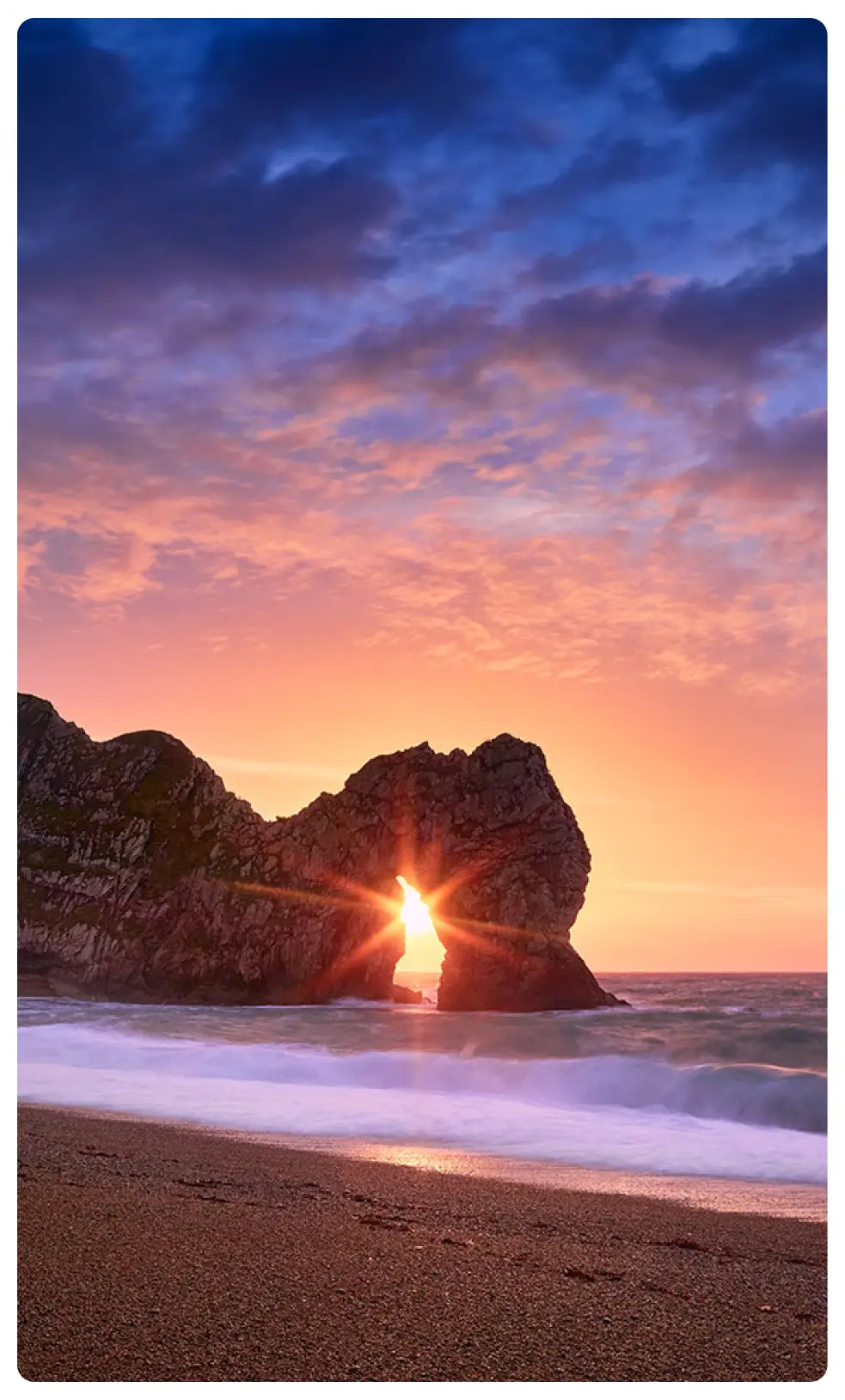

About Ward Goodman

Ward Goodman is a trusted financial advisory firm based in Dorset, dedicated to helping individuals and businesses navigate the often complex world of personal and business finance. Renowned for our expertise and tailored guidance, our experts provide insights and strategies to make your financial goals achievable.

For further details on the Autumn Budget 2024 and its potential impact, download Ward Goodman’s free comprehensive Autumn Budget Summary today.